MGMA Insight Article published April 2020

Blanket Start Waiver

On March 30, 2020, the Department of Health & Human Services (HHS) issued a blanket Stark Law waiver addressing a variety of compensation arrangements in an effort to expand capacity and reduce barriers to innovative models of care.

The waiver is for arrangements specific to COVID-19-related purposes. These waivers were retrospectively applied from March 1 and shall expire once the national state of emergency is lifted. On April 3, the Office of Inspector General (OIG) issued a policy statement indicating that it will “not impose administrative sanctions under the Federal anti-kickback statute for certain remuneration” related to the blanket waivers issued by HHS (Section 1128B(b) of the Act, 42 U.S.C. § 1320a-7b(b)). HHS identified 18 blanket waivers in its pronouncement.

Those waivers addressed within the scope of this article pertain to the following:

- Remuneration from an entity to a physician that is above or below the fair market value (FMV) for services personally performed by the physician.

- Rental charges paid by an entity to a physician that are below FMV for the entity’s lease of office space, equipment, or items/services from the physician.

- Rental charges paid by a physician to an entity that are below FMV for the physician’s lease of office space, equipment, or items/services from the entity.

- Remuneration from an entity to a physician that exceeds the nonmonetary compensation limits.

The waivers provide greater flexibility to the parties involved as compensation terms change in accordance with the changing environment. While this affords physicians and systems a significant amount of latitude with respect to compliance, it does not preclude them from ensuring that the arrangements remain commercially reasonable, consistent and absent of fraud or abuse.

As we have worked these past few weeks guiding our clients through these challenges, we have drawn upon our lessons learned in the aftermath of Hurricane Katrina. What follows below are observations, recommendations and guidance to ensure operational and financial viability of physician resources as we move from the initial phase of the pandemic during the state of national emergency. While informative and rooted in valuation analysis, this is not meant to substitute for legal advice. Actions to address this should include the following:

- Establish protocols and guidelines

- Consistently apply compensation methodologies across similar specialties and/or service arrangements

- Document protocols contemporaneously to support the decisions being made

- Be aware that the waiver is not for rental rates (office space, equipment, or items/services) above FMV

- Evaluate the community health needs assessment by specialty and plan accordingly.

Physician Compensation: A tale of two burdens

With the federal government issuing its “Opening Up America Again” plan on April 16, health systems and practices will continue to re-evaluate the current compensation arrangements. Some physician specialties are inundated with patients whereas others have experienced significant drops in volumes, as much as 75%.1 These disparate realities for physicians further confirm that a functional compensation plan should not be static but rather dynamic in its response to various circumstance. The degree to which the plan is responsive is contingent upon the entities’ active review and management of the compensation plan.

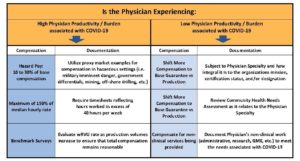

The COVID-19 Physician FMV Compensation Map (Figure 1) helps guide compensation within the context of the Stark blanket waiver and national state of emergency. The map details the criteria to be eligible for the waiver based on whether the financial arrangement is related to a COVID-19 purpose. The recommendations that follow are based on whether you are addressing a physician with increased productivity/burden associated with COVID-19 or a physician who has experienced a disruption in volumes associated with COVID-19.

Figure 1. Excerpt from HMS COVID-19 Physician FMV Compensation Map

Click on the table excerpt above to download a PDF copy of HMS’ full COVID-19 Physician FMV Compensation Map Under the Stark Blanket Waiver.

When addressing physician compensation, HHS specifically noted an example of a hospital paying physicians above their previously contracted rate for furnishing professional services for COVID-19 patients in particularly hazardous or challenging environments. This is one example of the Hazard Pay component of compensation listed in the table above.

Should the eligibility criteria not be met, our recommendation would be to consider an FMV analysis. Physician compensation needs to be specific to each physician and their specific set of circumstances. As a result, compensation plans need to be responsive as we proceed through this pandemic.

Rental charges for office space, equipment, or items/services

When it comes to rental charges, physicians and entities may charge less than FMV; however, they may not charge in excess of FMV for leasing office space, equipment or items/services to an entity. Some examples that HHS provided to help guide physician offices are as follows:

Rental charges paid by an entity to a physician practice or by a physician practice to an entity

- To accommodate patient surge, a hospital rents office space or equipment from an independent physician practice at below fair market value or at no charge.

- A hospital provides free use of medical office space on its campus to allow physicians to provide timely and convenient services to patients who come to the hospital but do not need inpatient care.

- An entity sells personal protective equipment to a physician, or permits the physician to use space in a tent or other makeshift location, at below fair market value (or provides the items or permits the use of the premises at no charge).

Since the compliance risk for physicians and entities pertains to charging or paying in excess of FMV, the need to understand the upper limit to the charge continues even in the context of the blanket waivers.

Other examples of pertinent waivers provided by HHS

Remuneration from an entity in excess of the non-monetary compensation limits

- A hospital provides meals, comfort items (for example, a change of clothing), or onsite childcare with a value greater than $36 per instance to medical staff physicians who spend long hours at the hospital during the COVID-19 outbreak in the United States.

- An entity provides nonmonetary compensation to a physician or an immediate family member of a physician in excess of the $423 per year limit (per physician or immediate family member), such as continuing medical education related to the COVID-19 outbreak in the United States, supplies, food, or other grocery items, isolation-related needs (for example, hotel rooms and meals), child care, or transportation.

Physician-owned hospitals and/or ambulatory surgery centers (ASCs)

- With state approval (if required), a physician-owned hospital temporarily converts observation beds to inpatient beds or otherwise increases its inpatient bed count to accommodate patient surge during the COVID-19 outbreak in the United States.

- Consistent with its state’s emergency preparedness or pandemic plan, a physician-owned ASC enrolls as a Medicare-participating hospital, even if it is unable to satisfy the requirements of section 1877(i)(1) of the Act, in order to provide medically necessary care to patients during the COVID-19 outbreak in the United States.

Compensation plans need to be living and responsive as we proceed through this pandemic. HMS is committed to providing the resources and guidance to our clients both during and after COVID-19. Should you wish to discuss any specific compensation arrangements or agreements, do not hesitate to contact us.

1Bebinger M. “COVID-19 Hits Some Health Care Workers with Pay Cuts and Layoffs.” NPR. April 2, 2020. Available from: https://n.pr/2VEMaY0.

The information provided herein is accurate as of the date of entry and relies on data available at the time of writing. Given the rapidly changing environment, the information provided is intended as a resource only and should not replace direct consultation of relevant laws, policies, and guidelines. HMS Valuation Partners is committed to ensuring that clients have accurate and up-to-date information and is closely monitoring any changes in policy and practice relevant to COVID-19.