Recent weeks have seen activity in the legislature regarding the proposed ban on “Surprise Medical Billing” legislation. It is receiving bipartisan support and likely to continue to law. While providers are actively trying to shape this legislation, hospitals who contract with them need to prepare for potential pressure from these providers.

Hospitals across the county continue to increase their contracts with separate entities for one or more hospital-based coverage services. These services intersect with areas such as the emergency room department, NICU, labor & delivery unit, anesthesia services, and radiology services, to name a few. Patients primarily enter these departments from either an emergent visit (i.e. trauma) or an elective service (i.e. non-emergent gall bladder removal). In either of these cases, patients may find themselves in a hospital listed as an in-network provider through their insurance company; however, the additional services received may be from out-of-network providers. Emergent visits may result in professional services being provided by emergency room providers, ambulance services, and specialty physicians such as surgicalist, hospitalists, and/or laborists. In addition to the specialty physicians, non-emergent cases may result in the patient receiving other services like radiology and anesthesia. As stated above, many hospitals subcontract for these services and these subcontractors may be an out-of-network provider, resulting in the patient’s insurance only paying a fraction of the amount billed. As a result, patients receive “surprise” large bills for these out-of-network services provided.

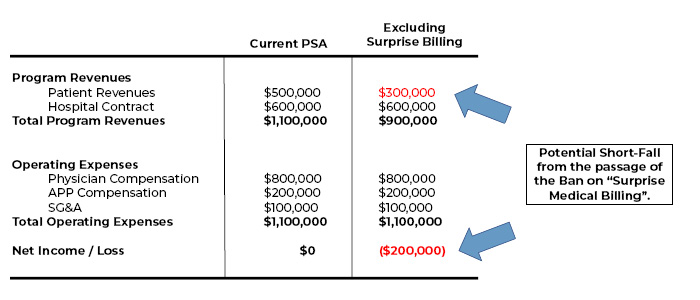

With the potential passage of this new legislation, subcontractors that are out-of-network may be limited in the amount that can be billed to these patients. Additionally, the passing of this legislation also may potentially result in a loss of revenue for many of the subcontracting groups and independent practices providing these hospital-based coverage services. See the example below illustrating an Income Statement from an Emergency Room Program that is paid a per diem rate by the hospital to cover the department:

Under this illustration, the potential loss in patient revenues from the limited ability to balance bill is $200,000 per year. With the majority of these groups generating revenues from professional services plus some form of contractual payment from the hospital (i.e. per diem rate), there will probably be increased pressure on hospitals to increase their contractual payment to make up the shortfall.

Hospitals should be prepared for these potential requests. As they evaluate each arrangement, it will be important to ensure that the fair market value (FMV) opinions used to support the program’s compensation accurately reflects all relevant revenues. Contractors may become more creative to minimize the potential loss in revenue by seeking revenue streams from other sources, as is the case with laborist participation fees and/or becoming in-network providers. In either case, the revenues used to determine the FMV rate needs to accurately reflect the circumstance or the rate may potentially fall outside of FMV.

By Joe Aguilar, Partner

Don Crawford, Partner