With the myriad of physician compensation models used by health systems, medical groups, and private practices, wRVU productivity remains a common means to determine all or part of a physician’s annual compensation. Each physician’s wRVU productivity can be tallied based on their CPT codes billed and the corresponding wRVU value attributed to each code by the Centers for Medicare and Medicaid Services (CMS). However, some professional services do not fit within one of the pre-defined or otherwise specified procedure by CMS, and physicians are required to use an unlisted CPT code without a wRVU value assigned.

What happens when a physician provides a professional service using a CPT code where there is no wRVU attributed to it?

Well, generally it fosters a lot of angst amongst the physicians as they consider the impact on their compensation. Organizations have attempted to compensate for unlisted services based on a variety of ways including a wRVU credit, percent of professional collections, pre-determined fixed rates, and/or hourly rates. In some cases, the contract wRVU conversion rate is set at a level that already takes into account the value of the unlisted services performed. While each of the above methods have merit, this piece will discuss the assignment of a wRVU credit or value for unlisted services based on proxy, reimbursement, and physician time.

Based on proxy

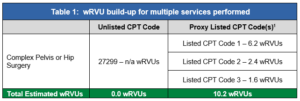

When possible, attempts should be made to find an appropriate proxy service to determine the wRVU value for the service. An appropriate proxy would be a service that most closely approximates the physician’s work effort and/or financial remuneration. Example could be a complex pelvis or hip surgery requiring multiple procedures not captured under any listed CPT codes. These cases may require a unique surgical approach or technique and/or a different level of work when compared to the listed codes available. See Table 1 below for an illustration of building up a wRVU value for an unlisted pelvis or hip surgery under CPT code 27299.

Note 1: wRVUs are estimated for this example and are assumed to be adjusted based on the appropriate modifier assigned. This example is for illustrative purposes only to visualize the build-up of value for an unlisted service.

Because the unlisted code is used when no other code accurately describes the service, the resulting wRVUs will vary and be dependent of the specific services performed.

Based on reimbursement

The assignment of a wRVU value to an unlisted procedure should also consider the reimbursement for the service, as it represents the economic value placed on the service. While this amount may not accurately reflect the physician’s work effort in all cases, it is worth reviewing from the perspective of setting a wRVU value that is financially sustainable.

The first step is to determine the reimbursement comparable to use. Two such options are illustrated below in Table 2. The first option utilizes the physician’s current total professional collections on all listed procedures, and the second option uses total professional collections from listed procedures for similar services to the unlisted procedure. In each case, the total professional collections are divided by the total wRVUs for the same set of procedures to derive a collections per wRVU ratio. This ratio is then applied to the professional collections received for the unlisted procedure. By dividing the ratio into the professional collections for the unlisted procedure, you arrive at an estimated wRVU value for the unlisted procedure.

The illustration above demonstrates that selecting the appropriate collections per wRVU ratio will have an impact on the resultant wRVU value calculated. As a result, care should be taken when determining the basis for the collections per wRVU ratio.

While the example above uses the physician’s actual collections per wRVU performance, some organizations will use survey data to derive the collections per wRVU ratio. While this may be prudent in certain situations, the concern would be that the ratio is not specific to the physician’s payor mix and resulting collections performance. Lastly, some organizations use the charge per wRVU ratio instead of the collections per wRVU. While charges should be set to reflect the work effort and economic value of the service, this is not always reflected in the physician fee schedules.

Based on physician time

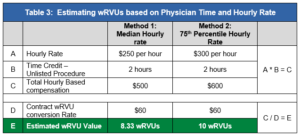

Another common means of determining the wRVU value for an unlisted service is based on the physician’s work effort expressed in time spent. This method requires an interview with the physician performing the service. It is a method that is often well received as it is easily understood, and the physicians can see the direct relationship between their time spent and compensation. However, care should be taken when deciding on the time to be used as well as the hourly rate in the calculation.

- Time: Time should be measured based on the time spent on direct patient care. For surgical services, time is usually measured based on the time spent in the operating room.

- Hourly Rate: The hourly rate used should be a function of the skillset needed to perform the service. Although the physician who is performing the unlisted service has an implied hourly rate based on their contract compensation and hours worked, it may not be the most appropriate rate to use for the given unlisted service. Organizations could also look to the survey data at the median or consider the 75th percentile for more complex procedures.

See Table 3 below for an example on deriving an estimate wRVU value for an unlisted service.

Summary

Each of these methods discussed above will have varying degrees of relevancy based on the unlisted service in question. As such, organizations should weigh these methods accordingly when deriving the wRVU value. After an estimated wRVU value is determined, it should be reviewed annually for appropriateness as well as for CMS changes converting the unlisted service to a listed service with an assigned wRVU value.